Wednesday, 15 April, 2015

The latest Australian Housing Outlook report confirms our property market is on the upswing.

Real estate agents, developers and property experts on the Coast are still buoyed by positive signs and activity in the local property market, and the latest Australian Housing Outlook report supports this optimism. The report, which is researched and compiled by BIS Shrapnel for QBE, looks at the drivers of the housing market and forecasts the trends that will affect it in the coming years.

So what does it say about the local market?

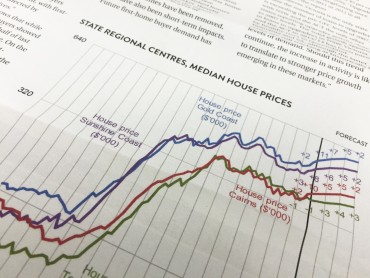

Property prices on the Sunshine Coast, along with the Gold Coast, Townsville and Cairns, have been pretty flat since the 2007/08 peak. According to the report: “These Markets were hampered by an oversupply of dwellings after the peak and generally weak local economic conditions, while other parts of regional Queensland enjoyed a boom in resource sector investment.”

Now, however, the local market is undersupplied and conditions are looking good for our region. The table shows that median prices should increase in the coming years.

“After a period of weakness, the local economy is being fuelled by the commencement of the $950 million Sunshine Coast University Hospital in 2013/14 and associated works,” says the report.

“Following a rise in the median house price of eight per cent in 2013/14, further healthy rises of six per cent and five per cent in 2014/15 and 2015/16 are forecast, slowing to two percent in 2016/17 as interest rates peak. A total rise of 14 per cent is forecast over the period.”

QBE CEO Jenny Boddington writes in her introduction to the report, “BIS Shrapnel has forecast a continuation of growth within the housing market in 2014/15, though increases will be more balanced across state capitals than in the previous year. Housing stock deficiency is set to remain a key indicator of growth in 2014/15.

“Market demand has been sustained with interest rates remaining at historically low levels. While we’re seeing new dwelling commencements currently exceeding average underlying demand in most states, it’s forecast that new supply will take some time to address tight vacancy rates and change the pattern of price rises. BIS Shrapnel is projecting that affordability at current interest rates can accommodate further price growth. Increasing market activity is most visible among non-first home buyers and in residential investment, with first-home buyer demand affected by available state incentives.”

Indeed, the report shows that while demand for first-home buyers showed signs of steadying in the first half of last year, it then continued to decline. On the other hand, demand from non-first-home buyers has been slowing since the end of 2013, though the report states there are signs this activity is again picking up.

Because demand from first-home buyers creates a need for entry-level properties, they are an important component of the market because this then “facilitates broader demand by encouraging current occupiers to upgrade through the value chain”. This is why governments will often resort to incentives to increase demand from first-home buyers when the market is weak.

In the table, which shows incentives offered specifically to first-home buyers from federal and state governments since 2007, you can see there has been a decline in activity in line with a change in policy.

Incentives for first-home buyers around the country have progressively changed over the past three years, favouring buyers of new rather than established dwellings. “The long-term impact will be a shift of some first-home buyer demand that would have otherwise been for established homes into the new home market, thereby adding to supply,” says the report.

Incentives for first-home buyers around the country have progressively changed over the past three years, favouring buyers of new rather than established dwellings. “The long-term impact will be a shift of some first-home buyer demand that would have otherwise been for established homes into the new home market, thereby adding to supply,” says the report.

As incentives for buyers of established homes have been removed, there have also been short-term impacts. “Future first-home buyer demand has been brought forward to take advantage of the grants before they expire,” says the report, “leaving a vacuum of first-home buyers in the established market immediately afterwards.”

Another impact is on the next round of buyers, as they delay buying their first homes in order to collect the larger deposit that they will need to “compensate for the lack of financial assistance”.

The report says upgraders and downsizers account for about 45 per cent of residential lending activity. “Upgrader demand has been strengthening since bottoming out in 2011 or 2012 in all states,” says the report.

“However, Victoria is the only state where the number of loans to upgraders is exceeding the pre-GFC levels of 2007, with NSW and the ACT the only other states reporting upgrader activity close to 2007 levels. The solid growth apparent in loans to upgraders in NSW, Victoria and the ACT in 2013/14 has been joined by healthy rises in Queensland, Tasmania and SA, although the latter states are still tracking at historically low levels of demand. Should this trend continue, the increase in activity is likely to translate to stronger price growth emerging in these markets.”

My Weekly Preview April 10, 2015

Tags: Apartment Living, business, CBD, development, maroochy boulevard, Maroochydore, Sunshine Cove, Sunshine Plaza, waterfront

Posted in Press Clippings